2025 Outlook: Five Shifting Forces in the Tractor Market

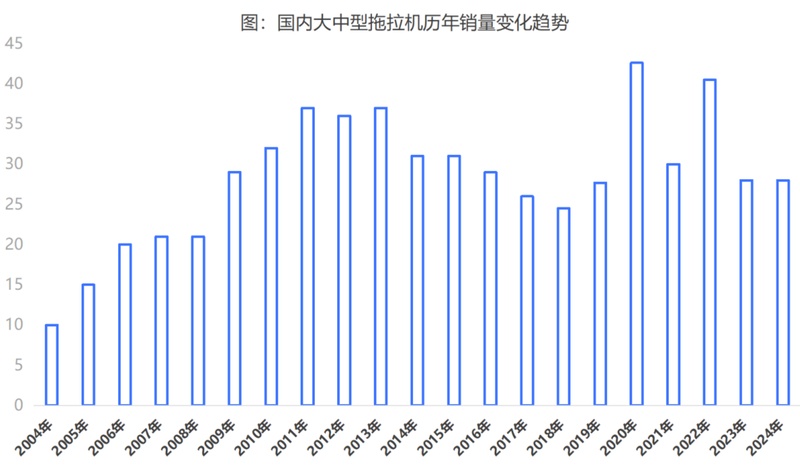

In 2024, the domestic tractor industry is experiencing a downward trend, with a year-on-year decrease of about 15% in demand for large and medium-sized tractors. At the same time, about 40 brands have withdrawn from the market. As 2025 approaches, the tractor market will face five main forces of reshuffling: technological reshuffling, policy reshuffling, strength reshuffling, demand reshuffling, and cyclical reshuffling.

These forces will jointly shape the future pattern of the tractor market, bringing new opportunities and challenges to the industry.

1、 Technical shuffling

There are many forces that affect the tractor industry, but the most profound impact is technological change. Technological mutations often overturn the existing competitive landscape. Companies that master new technologies can rely on their technological advantages to rise against the trend and become new leaders in the industry.

Tesla and BYD have seized the opportunity of electrification in the technological transformation of new energy vehicles and become the new dominant players in the automotive industry. Fuel car giants such as Volkswagen, BMW, Mercedes Benz, Toyota, and Honda are helpless in the new energy era.

The domestic tractor industry is in a period of technological mutation, and new technology enterprises can use the power of technology to reshuffle, and even "topple the leader and become the leader themselves". This is the inevitable development of technology and the inevitable competition.

There are four new technological routes emerging in the domestic tractor industry: power shifting, CVT, hybrid, and pure electric. Different companies have chosen different technological routes, and for the first time, there has been a serious technical divergence in the domestic tractor industry. If nothing unexpected happens, the phenomenon of "divergent paths leading to sheep's demise" will be manifested in the tractor industry.

Power shift technology. After the engagement sleeve, shuttle shift, and power direction change, it is called power shift, so some people say that power shift is the mainstream direction for tractor upgrades.

At present, the leading domestic tractor manufacturer, Yituo Group, has chosen power shifting technology, and it is expected that Eastern Red tractor manufacturers will also follow Yituo to capture the high ground of power shifting.

CVT technology, also known as continuously variable transmission. From the development stage of the tractor market in Europe and America, CVT is a more advanced transmission technology after power shifting, with higher requirements for materials, processes, processing equipment, processing capabilities, assembly levels, and after-sales service. It was once a technology only mastered by European and American enterprises.

At present, it has been conquered by companies such as Weichai Lovol, Yituo Group, Shaanxi Fast, Weichai Power, etc. Weichai Lovol has chosen CVT technology as its main focus, so many "Foton series" tractor companies will also follow Lovol into the CVT highland, but there will not be too many companies with this ability.

Oil electric hybrid technology. At present, the main technological routes are range extender and plug-in hybrid. Guangxi Yuchai provides plug-in hybrid power chassis assemblies and control systems for many domestic third - and fourth line brands, which can be considered a comprehensive solution. Against the backdrop of tractor technology upgrades, domestic third - and fourth line brands only have this one opportunity to change their fate. If EVT cannot defeat the power shift and CVT controlled by large enterprises, these low-end brands will exit the market in batches.

Pure electric tractor. The ultimate direction of tractors is pure electric, but there are still several transitional schemes and technical routes between the meshing sleeve and pure electric.

In 2024, it is clear that tractor companies are no longer interested in pure electric vehicles. At the Changsha Conference, only a few tractor companies such as Huanghai Jinma and Hanwo launched pure electric tractors, all of which are low-power tractors with 30-70 horsepower.

Small and medium-sized electric vehicles are facing the risk of being replaced by large ones. On the one hand, the market capacity of pure electric small and medium-sized electric vehicles is decreasing, and on the other hand, the investment return rate is low. Users and enterprises are not interested, so the short-term prospects are not optimistic.

Although domestic tractors face the challenge of technology selection, and businesses of all sizes are confused, technological reshuffling is one of the core driving forces for tractor market transformation. With the upgrading of emission standards and the development of intelligent technology, technological reshuffling in the tractor industry is inevitable.

2、 Policy reshuffle

Policy reshuffle is an important external factor in the transformation of the tractor market, and this article specifically refers to the agricultural machinery purchase subsidy policy.

The impact of agricultural machinery purchase subsidy policies on the tractor industry is far greater than market demand, technological changes, and other factors. The makers of agricultural machinery purchase subsidy policies will fully consider market demand and technological factors, but the influence of tangible big hands on the industry is unparalleled. In China's agricultural machinery industry, you may not understand the market, and even look down on technology, but you must study subsidy policies. Only enterprises that resonate with subsidy policies can enjoy policy dividends. Going against subsidy policies is destined to achieve nothing.

Specifically for tractors, the two main directions supported by the new round of purchase subsidy policies from 2024 to 2026 are "optimizing machinery and subsidies" and "supporting the strong and the strong".

'Youji Youbu' refers to intelligent control tractors, which are equipped with electromechanical hydraulic integrated electronic control technology for power shifting, as mentioned earlier CVT、EVT、 New energy tractors, as well as high-quality and high-efficiency tractors, are aimed at powerful large enterprises.

The clear direction of 'supporting excellence and strengthening' refers to large brands and leading enterprises with outstanding technological research and development capabilities, good production and manufacturing foundations, and the ability to produce technologically advanced and high-quality tractors.

That is to say, the policies of "optimizing machinery and subsidies" and "supporting the strong" are biased support for large brands and leading enterprises. Large enterprises already have the strength to carry out reshuffling, and with the tangible big hand of policies, the reshuffling speed of the domestic tractor industry will accelerate, and it will be washed more thoroughly.

3、 Strength reshuffle

Regardless of whether there is technological or policy support for the reshuffle, several leading domestic tractor companies will initiate a reshuffle, which is an inevitable result of market competition. Without purifying the market, big brands cannot obtain a long-term stable external environment.

Since 2020, leading companies such as Yituo Dongfanghong, Weichai Lovol, and Dongfeng Agricultural Machinery have coincidentally launched a reshuffle war to regain lost ground and seize market share from competitors.

Weichai Lovol has set a target plan for over 1000 dealers to increase their market share year by year, but those who fail to meet the plan face serious consequences of revoking their authorization.

In the domestic tractor industry, multinational companies such as John Deere, CNOOC, and AGCO have the strength to reshuffle, as well as leading domestic enterprises such as Yituo Dongfanghong, Weichai Lovol, and Dongfeng Agricultural Machinery. However, multinational companies occupy the high-end market and have no intention of participating in the reshuffle of the domestic tractor industry. Therefore, the main force in the reshuffle of the domestic tractor industry is the leading domestic brands.

If not unexpected, the reshuffling of the domestic tractor industry and even the agricultural machinery industry will be completed by leading companies such as Weichai Lovol and Yituo Group, but there is still great uncertainty behind this:

Firstly, companies with strong backgrounds such as Zhonglian, Yingxuan, and Jianghua Machinery cannot be eliminated through market-oriented means; Secondly, it depends on the performance of engineering machinery giants such as XCMG, LiuGong, Tiejian Heavy Industry, and Lingong. If these cross-border giants work seriously on agricultural machinery, there is a great possibility that the existing competitive landscape of the industry will be redefined; The third is the uncertainty of new forces in agricultural machinery, such as whether hybrid technology will help low-end brands change their fate against the odds? Will electric tractors quickly replace fuel vehicles?

4、 User shuffling

The demand side (consumer side) of agricultural machinery is undergoing significant changes, and the recent news of China Railway 14th Bureau transferring 15000 acres of farmland in Dongying, Shandong to plant winter wheat has attracted great attention from both inside and outside the industry.

Several factors that affect changes in domestic tractor demand include land transfer, high standard farmland construction, land trusteeship, and state-owned enterprise cultivation.

Large scale land transfer began in 2009. According to data released by the National Bureau of Statistics, as of 2022, the domestic land transfer area is 532 million mu, which is approximately 40%.

The construction of high standard farmland started in 2013 will be completed by 2022. The state will issue about 100 billion yuan of special treasury bond every year to support the construction of high standard farmland. In the next few years, 50 million mu of high standard farmland will be built every year, and 30 million mu of high standard farmland will be upgraded.

After 2020, the government will support large-scale land trusteeship and social services.

The joint role of land transfer, high standard farmland construction, and land trusteeship is to improve the level of large-scale agricultural production. Behind this is the rise of organized users such as large-scale grain growers, agricultural cooperatives, agricultural machinery cooperatives, and agricultural investment companies. China's agriculture is transforming from a small-scale agricultural economy to a modern large-scale agriculture, and only organized users can undertake this responsibility.

China Railway 14th Bureau has already started farming, along with state-owned and central enterprises as organized users. The era of organized agriculture machinery industry in China has arrived.

Organized users not only eliminate individual retail investors, but also reverse eliminate distributors and service organizations, until agricultural machinery production enterprises are eliminated.

Organized users correspond to large enterprises, big brands, powerful distributors, and professional service organizations. In recent years, in the bidding and procurement of some agricultural investment companies and central state-owned enterprises, the domestic top brands of imported brands have a high winning rate, while small brands have almost no chance of winning. Therefore, organized users will reverse the elimination of supply side enterprises.

5、 Periodic shuffling

Periodic reshuffling is a natural law of transformation in the tractor market. The domestic tractor industry experienced its peak in 2013 and has been in a period of turbulence and consolidation ever since. After the COVID-19 pandemic in 2020, there was a policy stress response, and in 2022, there were two sudden changes from National III to National IV, but it did not affect the overall industry cycle.

After years of rapid development, the tractor market has gradually entered a stage of stock competition. The current situation is that the characteristics of the domestic tractor industry are a slowdown in demand growth, intensified competition among enterprises, and a decline in overall profit margins.

In this context, enterprises need to pay more attention to improving product quality and service levels, and win the market through technological innovation and differentiated competition. At the same time, the reshuffling of the industry will accelerate, and some companies that cannot adapt to market changes will gradually exit the market, while companies with core competitiveness will stand out.

Afterword: In summary, the five main forces driving the transformation of the tractor market are technology reshuffle, policy reshuffle, strength reshuffle, demand reshuffle, and cycle reshuffle. These forces will jointly shape the future pattern of the tractor market, bringing new opportunities and challenges to the industry. Faced with these forces of change, tractor manufacturers must constantly innovate and improve their products to meet market demand; Simultaneously strengthen technology research and development and brand building to enhance one's own strength; In addition, it is necessary to closely monitor policy changes and market dynamics to flexibly respond to market changes. Only in this way can we stand undefeated in fierce market competition and achieve sustainable development.

Author: Agricultural Machinery Spray

Source: Agricultural Machinery News Network

Related Products

Submitted successfully

We will contact you as soon as possible